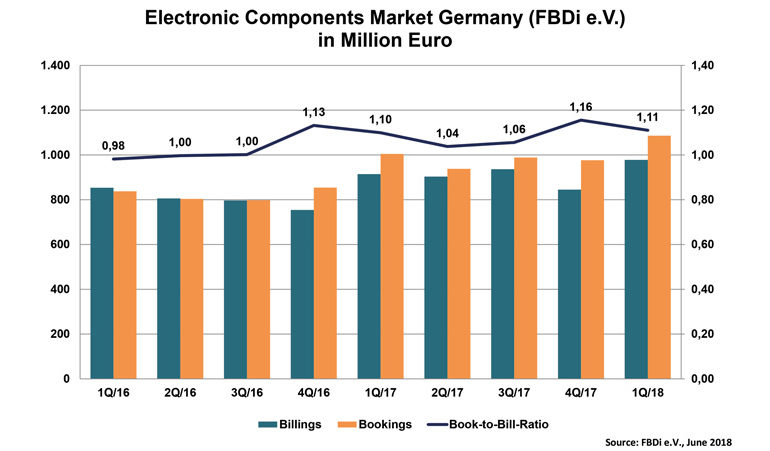

Overcoming the supply shortages affecting numerous electronic components, German distributors reported continued growth during the first quarter of 2018. For the period January to March 2018, the distribution companies organised under the Fachverband Bauelemente Distribution (FBDi e.V.) reported sales of 978m Euros – up 7% compared with Q1/2017.

Orders rose 8% to 1.09bn Euros. The book-to-bill ratio of 1.11 (the ratio of orders received to units shipped and billed) remains in the “green” zone.

Among the larger product segments, passive components recorded the strongest growth of 10.6% to reach 136m Euros, followed by the electromechanicals which rose 7.1% to 105m Euros. Semiconductor sales increased 6.5% to 676m Euros.

Power supplies surged 14% to almost 30m Euros, but sales of displays fell 5.5% to 22m Euros.

The sales breakdown remained virtually unchanged with semiconductors accounting for 69.1%, passive 13.9%, electromechanicals 10.7%, power supplies 3%, and the others amounting to 3.3%.

FBDi Chairman of the Board of Directors Georg Steinberger remarked: “The low growth rate for Q1/2018 is largely the result of delays to purchase orders and existing orders caused by the long delivery times affecting numerous components. There is little prospect of any significant easing of lead times for a wide variety of passive components. Based on our assessments, the first quarter is a good indicator for 2018 as a whole.”

“Although the economic indicators for the German electronics industry remain strong,” adds Steinberger, “and the capacity for innovation is high, economic policy tensions between the USA, Europe and China may very well act as a brake on growth.”

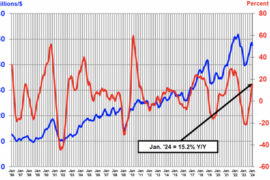

Turning to the component industry in particular, data from market researchers such as IC Insights show that investment in new production capacities in 2018 rose to more than $100bn for semiconductors alone, with the production of passive components also set to expand drastically.

“However, most market participants agree that demand for components in certain key products (smartphones) will continue to increase rapidly so that an easing is likely to occur in 2019 at the earliest. Consequently, price increases and long delivery times will set the tone for 2018,” added Steinberger.

Comments are closed.