With one bound the European semiconductor distribution market was free from its COVID blues.

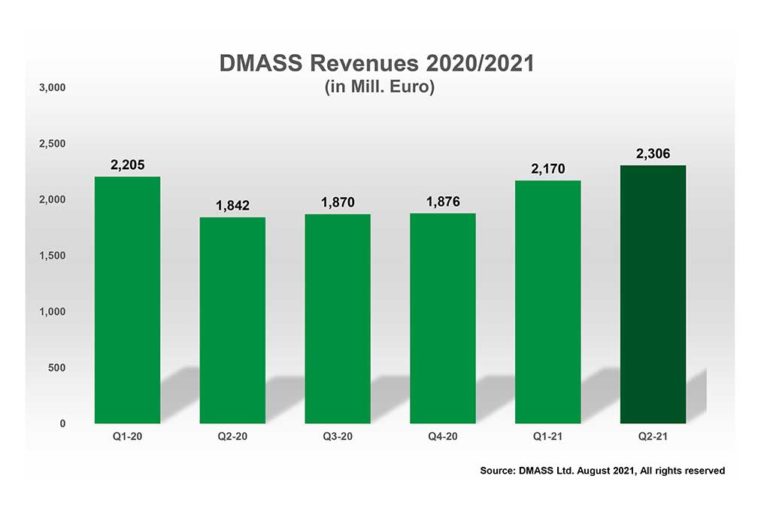

While Q1 was still negative, Q2/21 more than compensated for it and ended up with 25.2% growth to over 2.3 Billion Euro combined distribution revenue of all DMASS members.

Said Georg Steinberger, chairman of DMASS: “As indicated a few months ago, the dominating questions this summer are: where to source components to avoid production stops at customers and how long will the shortage last? In both cases the answers are pretty much open. Predictions on the shortage longevity range from anywhere between right after this summer to way beyond the summer of 2022. The unknown in that case is not production, as new capacities will not come online any time soon, but the more than fuzzy demand from the customer side. 2021 is probably safe from a sales perspective and will end up between 15 and 20%, but beyond that…”

At a country or region level, the overall situation is extremely positive, with double-digit growth almost across the board, but the variations are quite significant.

While Northern and Eastern Europe, the UK, Iberia, Benelux, Italy, Turkey and some smaller countries (a.k.a. Rest of Europe) grew between 28% and 77%.

Germany ended up 15.1% to 614 Million Euro, Italy climbed 30.4% to 212 Million Euro, the UK soared 37.3% to 167 Million Euro, France grew 19.8% to 149 Million Euro, Eastern Europe scored 44.1% growth to 403 Million Euro and Nordic rose 28.4% to 180 Million Euro.

Georg Steinberger added: “What is interesting to note is that especially France and Germany as the major EU countries have difficulties in keeping up with the average growth rate. What is also quite amazing is the fact that the UK does not seem to struggle at all with any Brexit ramifications, at least not in the components business. Not that I want to indicate anything here.”

At a product group level, the development in Q2 has been almost entirely positive. If any areas seem to “struggle”, it would be Analogue, MOS Micro, Programmable Logic and Other Logic.

In descending order, Discretes rocketed 58% to 139 Million Euro, Memories flew up 49% to 214 Million Euro, Power surged 41.6% to 282 Million Euro, Sensors accelertaed 37.9% to 66 Million Euro, Opto advanced 33.2% to 222 Million Euro, Analogue improved by 22.9% to 663 Million Euro and MOS Micro ascended 19.9% to 463 Million Euro.

Programmable Logic on the other hand drooped 11.8% to 114 Million Euro and Other Logic fell 4% to 109 Million Euro.

“What we are seeing at the product level is most probably an effect of the shortage that seems to have had a bigger impact on the major product groups of Analog and MOS Micro. The same might be true for Other Logic. Beyond that, it is really dependent on the mix of manufacturers and their specific delivery situation in the various product areas.,” concluded Georg Steinberger.

Comments are closed.